A chargeback occurs when your customer disputes a direct debit payment with their bank. In response, the customer's bank immediately reverses the payment by crediting the customer's account and pulling the funds from Belvo's account. Belvo then debits your balance to recover the payment amount and any associated fees.

In Mexico, direct debit disputes are regulated by the CIRCULAR 23/2009 from the Banco de Mexico. The customer that is charged via direct debit has a maximum of 90 calendar days from the transaction date to dispute a direct debit transaction. Each bank has different timeframes and processes for handling the dispute process. However, usually, once a customer has raised a chargeback claim the bank automatically credits the customer with the funds.

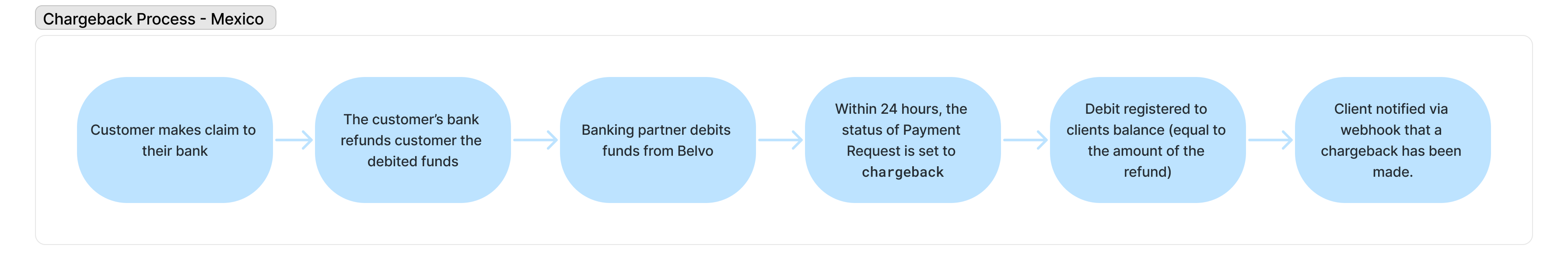

The following diagram illustrates the flow of a chargeback:

- Your customer informs their bank of the disputed direct debit transaction.

- Your customer's bank refunds the customer in the amount of the transaction.

- Belvo’s banking partner is notified of the chargeback and retrieves the amount from Belvo’s account.

- Within 24 hours, Belvo updates the

statusof the Payment Request tochargeback. - Belvo debits your balance in the amount of the transaction.

- Belvo notifies you via webhook that a chargeback has occurred.

In Mexico, the only option to reverse a chargeback is for you to reach out directly to your customer to clear up the matter and then make a new payment request.