With our Pix Biometria product, your users can approve payments without ever needing to leave your application. After enrolling their device, they will be able to make Pix payments using biometric authentication such as facial recognition or fingerprint.

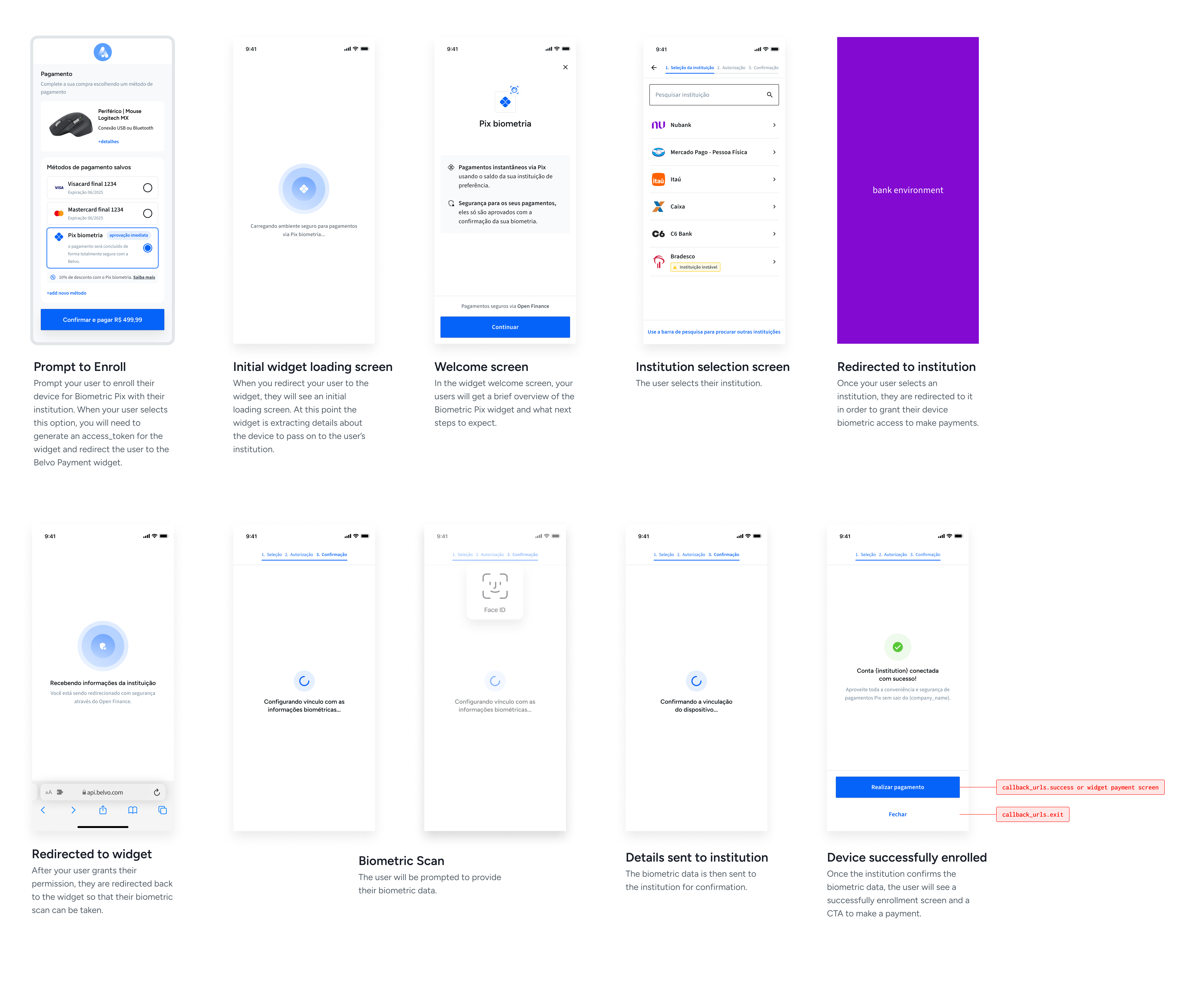

For each device and bank account that your users want to use for Pix Biometria payments, they will need to go through an enrollment. Enrollment is essentially the process of registering the user's device and biometric data with their institution.

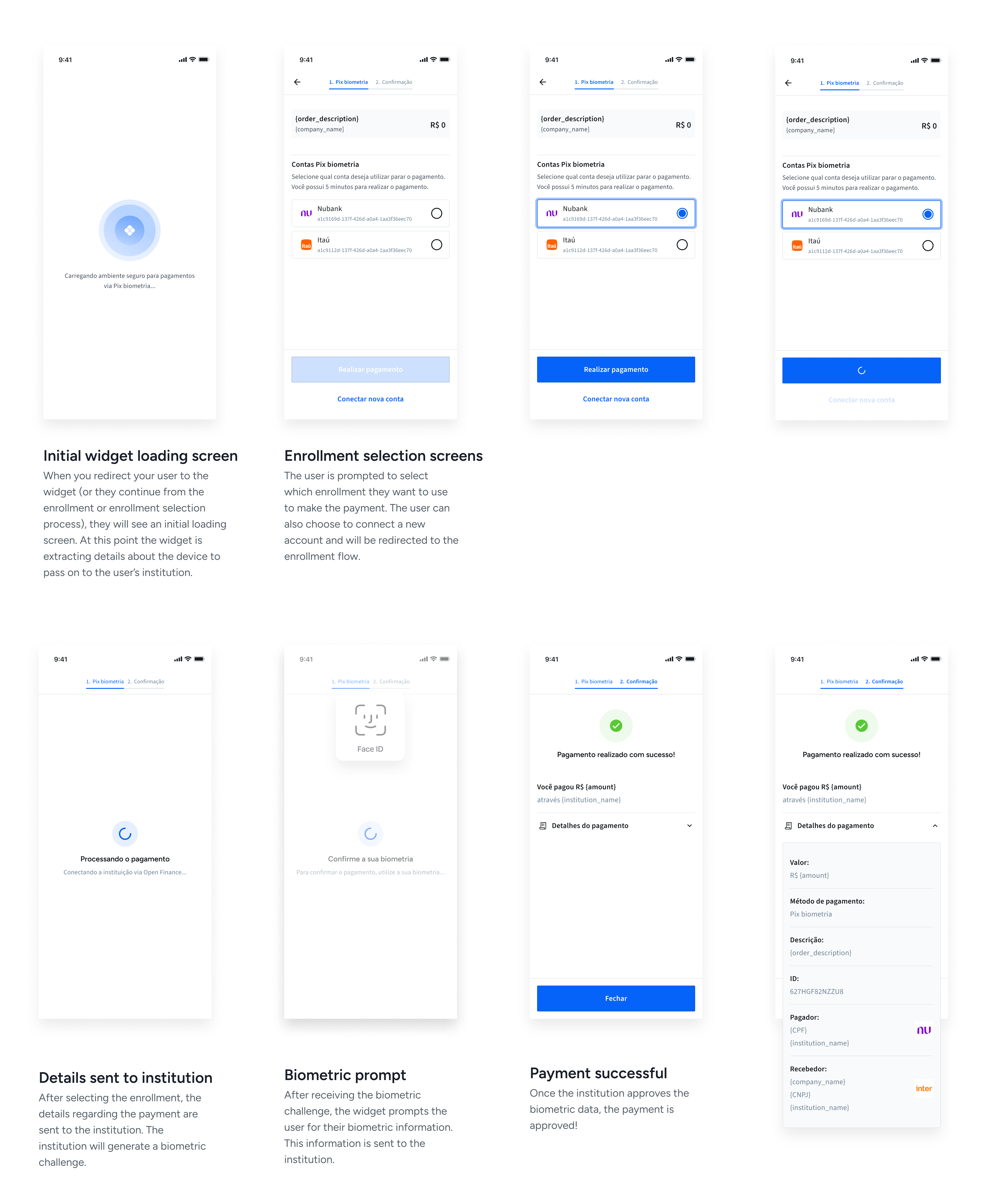

After your user has at least one enrollment, you can start making instant Pix payments! Below you can see a sample implementation, where the entire process occurs without any redirection to the users bank:

For Pix Biometria, we offer three integration options:

Our Pix Biometria widget is a fully embeddable and shareable checkout widgets, which already takes into account the regulatory requirements and best UX practices to drive the highest conversion possible for biometric payments.. The widget allows for some frontend customization (including Dark Mode) to match your app's experience, but the order of screens and actions cannot be changed.

Check out our dedicated Pix Biometria Widget guide for the step-by-step instructions.

Our iOS SDK provides native integration for biometric payments on iOS devices. It allows you to seamlessly integrate Pix Biometria functionality into your iOS application, supporting enrollment and payment flows with biometric authentication.

Check out our dedicated Pix Biometria iOS SDK guide for the step-by-step instructions.

Our Android SDK provides native integration for biometric payments on Android devices. It allows you to seamlessly integrate Pix Biometria functionality into your Android application, supporting enrollment and payment flows with biometric authentication.

Check out our dedicated Pix Biometria Android SDK guide for the step-by-step instructions.

Yes. Each device your user will use to make biometric payments (phone, tablet, computer) must be enrolled separately.

Yes. For security purposes, institutions will require users to re-enroll a device after its operating system has been updated.

A financial institution may reject or revoke an enrollment if its risk model detects factors that could compromise the security of the payment.

Yes. Currently:

- The daily transaction limit is set by the user's institution’s Pix limit.

- The per-transaction limit is set by the user, with a maximum of 500 BRL per transaction.

Yes. Users may have multiple enrollments if they are paying using multiple devices.

At present, there is no limit on the total number of enrollments a user can have.

By default, an enrollment expires after 5 years. However, users can set a shorter or indefinite expiration period when granting authorization for an enrollment.

Yes. Belvo is currently developing a solution to allow you to revoke an enrollment. Users can also revoke an enrollment directly with their financial institution.