Belvo's Pix Automático is a recurring payment modality defined by the Central Bank of Brazil that enables the automatic initiation of Pix transfers, based on a one-time authorization granted by the end user (payer).

Once authorized, a merchant can initiate recurring payments without requiring manual approval for each transaction (charge). These recurring payments can be configured with either fixed or variable amounts, depending on the business logic.

This feature is particularly useful for use cases such as:

- Subscriptions (for example, streaming services, SaaS, and membership programs)

- Monthly bills (for example, utilities, telecom, and insurance)

- Installments or monthly fees with adjustable amounts

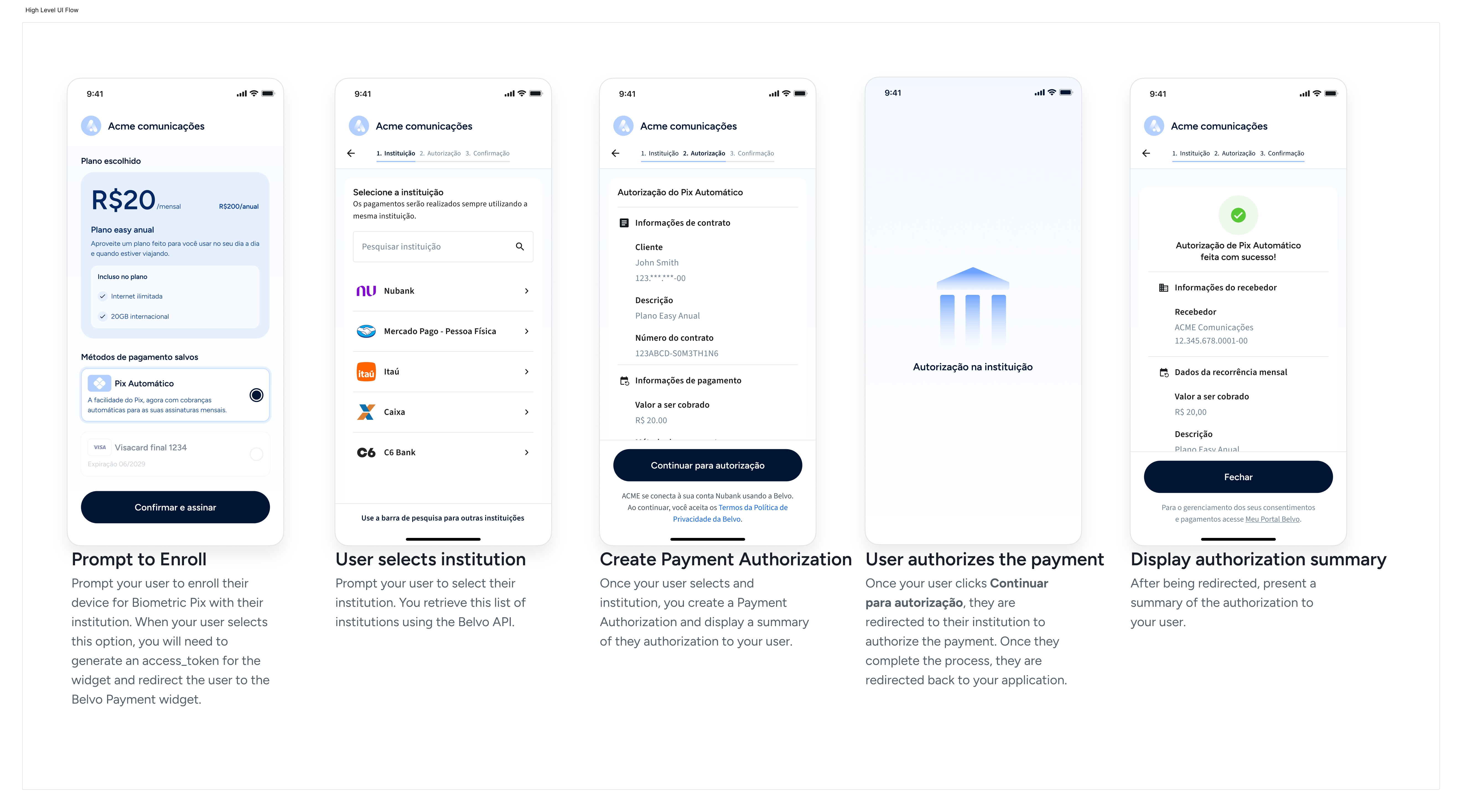

Below you can see our recommended flow for your application where:

- Present the possible payment methods (highlighting Pix Automático).

- List the supported institutions for your user to select.

- Once they select the instituion, you can generate the Payment Authorization. You must show the summary of the Payment Authorization to your user so that they can review it. To confirm the authorization, they will need to be redirected to their institution. For details regarding what information you must show in the summary screen, see the Required information to display in summary section below.

- The user confirms the authorization and is then redirected back to your application.

- Display a confirmation screen with the details of the authorization.

For the technical details of each step, please see our Direct API (Pix Automático) guide.

For Pix Automático, we offer one integration option:

Customize the user experience according to your brand needs and use our API to create and process payments.

We recommend this flow if your team has a dedicated set of engineers, product people, and designers to design and implement the payment flows and necessary screens, taking into account the regulatory requirements as this is a product regulated by the Brazilian Central Bank.

Check out our dedicated Direct API (Pix Automático) guide for the step-by-step instructions.

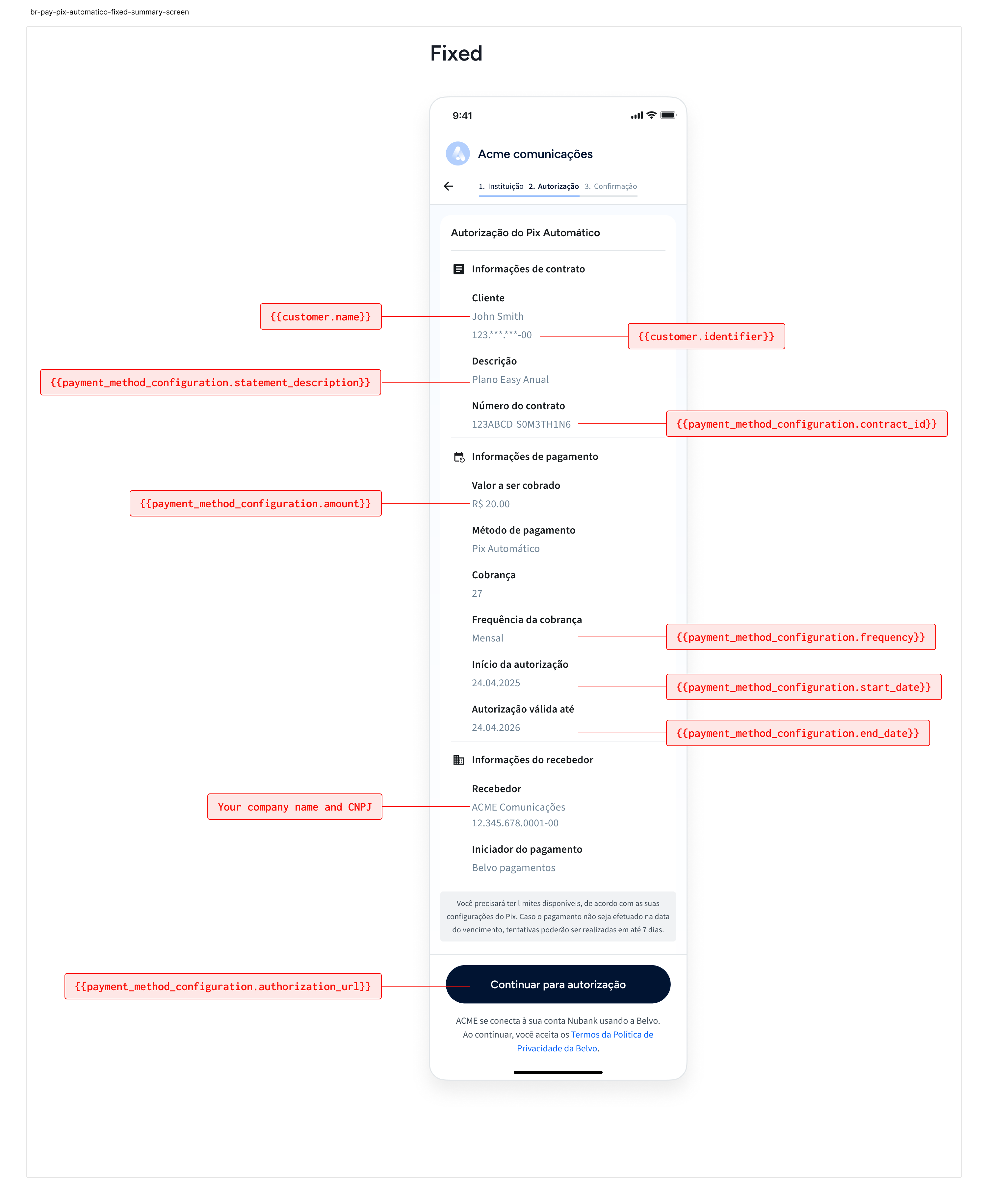

In the summary screen (before redirected the user to their institution), you must present the following data that you receive as a response from Belvo's API:

customer.namecustomer.identifierpayment_method_configuration.statement_descriptionpayment_method_configuration.contract_idpayment_method_configuration.amount(for Fixed payments)payment_method_configuration.maximum_amount(for Variable payments)payment_method_configuration.frequencypayment_method_configuration.start_datepayment_method_configuration.end_datepayment_method_configuration.authorization_url

In the case that you use the first_payment feature, the first payment will be processed immediately after the user confirms the authorization.

For more information, make sure to check out the detailed documentation about first_payment in our API Reference.

According to Brazil's Open Finance Network regulations, financial institutions must process scheduled payments according to the table below.

| Attempt | Timeframe (GMT-3) | Notified if failed? |

|---|---|---|

| First | 00:00 - 08:00 | No |

| Second | 18:00 - 21:00 | Yes |

If the first attempt to extract funds results in a failure, the institution will try again to process the payment later the same day. You are only notified that the given payment has failed after all attempts result in a failure. After the second attempt, you can then Retry the charge.

Financial institutions in the Open Finance Network must at least make one attempt to retry the payment in the 18:00-21:00 timeframe. However, the institution can make additional attempts in this period if they want to.