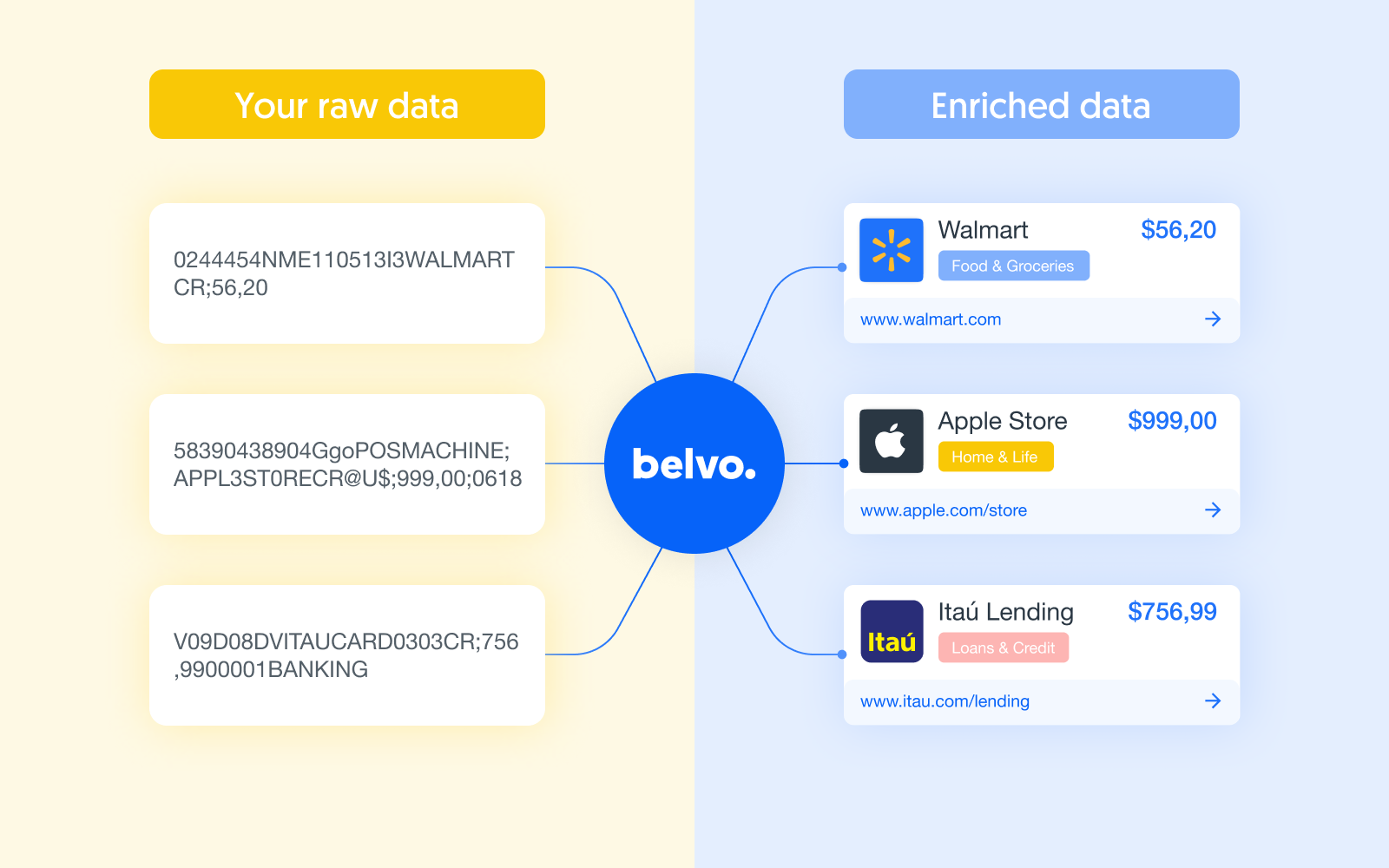

Enrich your own data (EYOD)

Belvo's Enrich Your Own Data (EYOD) feature enables you to enrich raw transaction data from any source. Whether you already have an existing dataset or are currently accessing open finance data, simply plug in your data, and we'll provide you with advanced insights that are customized to your specific needs:

- Categorization turns your raw transaction data into clean, organized, and enriched categories.

- Income Verification provides you with valuable visibility into your customers' income from multiple streams, including salaried wages, freelance earnings, and benefits.

- Risk Insights calculates over 120 data points that you can use in your data models.

- Recurring Expenses analyzes your provided transactions and identifies your user's recurring payments.

Belvo won't store your data in its database for using our EYOD resources. 🙂

Categorization

Belvo's Categorization resource allows you to categorize transaction data from any source. To do so, we only need information like the account type, amount, date, and description of each transaction from bank and credit card transactions.

The way it works is:

- You send your raw transaction data to Belvo.

- We process the transaction data and return category, subcategory, and merchant information, according to Belvo’s specifications.

Categorize transactions

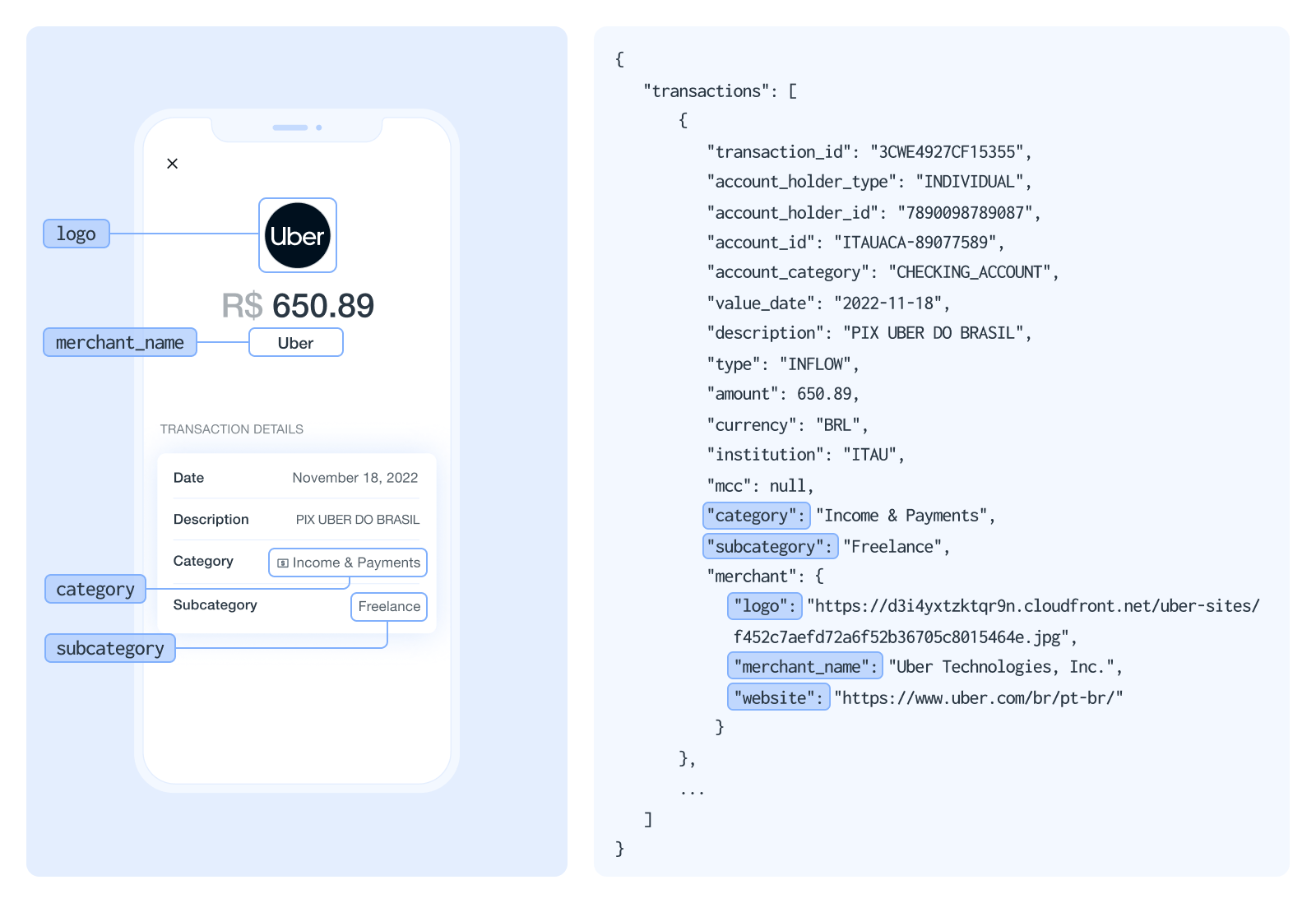

You’ll need to send a POST Categorize transactions request with raw transaction information (such as amount, description, and holder information) to which Belvo:

- provides additional information about the merchant involved in the transaction (name, logo, and website URL)

- assigns a standardized category to each transaction

- assigns a standardized subcategory to each transaction

You can send through up to 10,000 unique transactions per request. 😎

We offer the following method when it comes to interacting with Categorization:

| Endpoints | Method | Description |

|---|---|---|

| Categorize transactions | POST | Enrich transactions with category, subcategory, and merchant information. |

{

"language": "pt",

"transactions": [

{

"transaction_id": "3CWE4927CF15355",

"account_holder_type": "INDIVIDUAL",

"account_holder_id": "7890098789087",

"account_id": "ITAUACA-89077589",

"account_category": "CHECKING_ACCOUNT",

"value_date": "2022-11-18",

"description": "PIX UBER DO BRASIL",

"type": "INFLOW",

"amount": 650.89,

"currency": "BRL",

"institution": "ITAU"

},

...

]

}

{

"transactions": [

{

"transaction_id": "3CWE4927CF15355",

"account_holder_type": "INDIVIDUAL",

"account_holder_id": "7890098789087",

"account_id": "ITAUACA-89077589",

"account_category": "CHECKING_ACCOUNT",

"value_date": "2022-11-18",

"description": "PIX UBER DO BRASIL",

"type": "INFLOW",

"amount": 650.89,

"currency": "BRL",

"institution": "ITAU",

"mcc": null,

"category": "Income & Payments",

"subcategory": "Freelance",

"merchant": {

"logo": "https://d3i4yxtzktqr9n.cloudfront.net/uber-sites/f452c7aefd72a6f52b36705c8015464e.jpg",

"merchant_name": "Uber Technologies, Inc.",

"website": "https://www.uber.com/br/pt-br/"

}

}

]

}

Income Verification

Belvo's Income Verification resource enriches your transaction data so you can have visibility into your customers' income from various streams, including salaried wages, freelance earnings, and benefits.

To enrich your transaction data, send a POST Income Verification request with raw transaction information (such as amount, description, and holder information) to Belvo for income verification. Belvo processes it and returns:

- insights into your customer’s multiple income sources to verify their earnings.

- stability and regularity scores that reflect the consistency of your user’s income history.

- a confidence level score to forecast your user’s future income potential.

We offer the following method when it comes to interacting with Income Verification:

| Endpoints | Method | Description |

|---|---|---|

| Income Verification | POST | Enrich transaction data and gather insights on your user's income sources. |

You can send through up to 10,000 unique transactions per request.

{

"transactions": [

{

"account_holder_type": "INDIVIDUAL",

"type": "INFLOW",

"transaction_id": "3CWE4927CF15355",

"account_holder_id": "a61bc801-9fa5-457b-88ad-850c96eaca30",

"account_id": "EBUACA-89077589",

"account_category": "CHECKING_ACCOUNT",

"value_date": "2022-11-18",

"description": "SALÁRIO MENSAL",

"amount": 500,

"currency": "BRL",

"institution": "Erebor Brazil"

}

...

],

"allowed_income_types": [

"SALARY",

"TRANSFER"

],

"language": "pt",

"date_from": "2022-08-01",

"date_to": "2022-12-30",

"minimum_confidence_level": "LOW"

}

[

{

"link": "b834e69b-1aa4-465d-969c-07c886a4fbed",

"income_streams": [

{

"account_id": "EBUACA-89077589",

"income_type": "SALARY",

"source": "Gui Br",

"frequency": "MONTHLY",

"monthly_average": 150,

"average_income_amount": 1500,

"last_income_amount": 500,

"currency": "BRL",

"last_income_description": "SALÁRIO MENSAL",

"last_income_date": "2023-03-25",

"stability": 0.9,

"regularity": 0.8,

"trend": -0.1,

"lookback_periods": 10,

"full_periods": 5,

"periods_with_income": 5,

"number_of_incomes": 6,

"confidence": "HIGH"

},

{

"account_id": "EBUACA-89077589",

"income_type": "TRANSFER",

"source": "Gui Br",

"frequency": "SINGLE",

"monthly_average": 3000,

"average_income_amount": "3000.00",

"last_income_amount": 3000,

"currency": "BRL",

"last_income_description": "Transferência da Gui",

"last_income_date": "2022-09-25",

"stability": null,

"regularity": null,

"trend": null,

"lookback_periods": 10,

"full_periods": 5,

"periods_with_income": 1,

"number_of_incomes": 1,

"confidence": "LOW"

}

],

"income_source_type": "BANK",

"first_transaction_date": "2022-09-25",

"last_transaction_date": "2023-03-25",

"number_of_income_streams": 5,

"monthly_average": 2000,

"monthly_average_regular": 1800,

"monthly_average_irregular": 200,

"monthly_average_low_confidence": 200,

"monthly_average_medium_confidence": 200.00,

"monthly_average_high_confidence": 200.00,

"total_income_amount": "12000",

"total_regular_income_amount": 10800,

"total_irregular_income_amount": 1200.00,

"total_low_confidence": 200,

"total_medium_confidence": 200,

"total_high_confidence": 200"

}

...

]

Need more info? Check out our API reference! 🤓

Risk Insights

Belvo's Risk Insights resource enriches your customer's transactional, account, and balance data and provides you with a comprehensive list of cleaned and pre-calculated features that your data science team can add to their models. For a general overview of the data points we provide, see our An overview of risk insights article.

We offer the following method when it comes to interacting with Risk Insights:

| Endpoints | Method | Description |

|---|---|---|

| Risk Insights | POST | Retrieve over 120 calculated data points regarding your user's asset, liability, transactional, and cash flow habits. |

You can send through up to 10,000 unique transactions per request. For more information, check out our API reference! 🤓

Recurring Expenses

With Belvo's Recurring Expenses resource, you can categorize and identify recurrent spending patterns of your users based on the transaction data you provide.

We offer the following method when it comes to interacting with Recurring Expenses:

| Endpoints | Method | Description |

|---|---|---|

| Recurring Expenses | POST | Identify recurring spending patterns based on your transactional data. |

You can send through up to 10,000 unique transactions per request. For more information, check out our API reference! 🤓

Updated 13 days ago