Verify your user's personal and banking information

Instead of manually asking your users to input their personal and banking details, you can programmatically verify their banking and personal information with just a few API calls. This means fewer errors, faster ID verification, and better onboarding.

By automating the account verification process, you can reduce your product's dropout rate by up to 25%.

By validating the user's information directly using Belvo's API, you can:

- ensure that you have the correct information about your user

- cut down on the time required to initiate payouts

- eliminate penny validation

- streamline your onboarding by cutting out manual processes

- reduce fraud

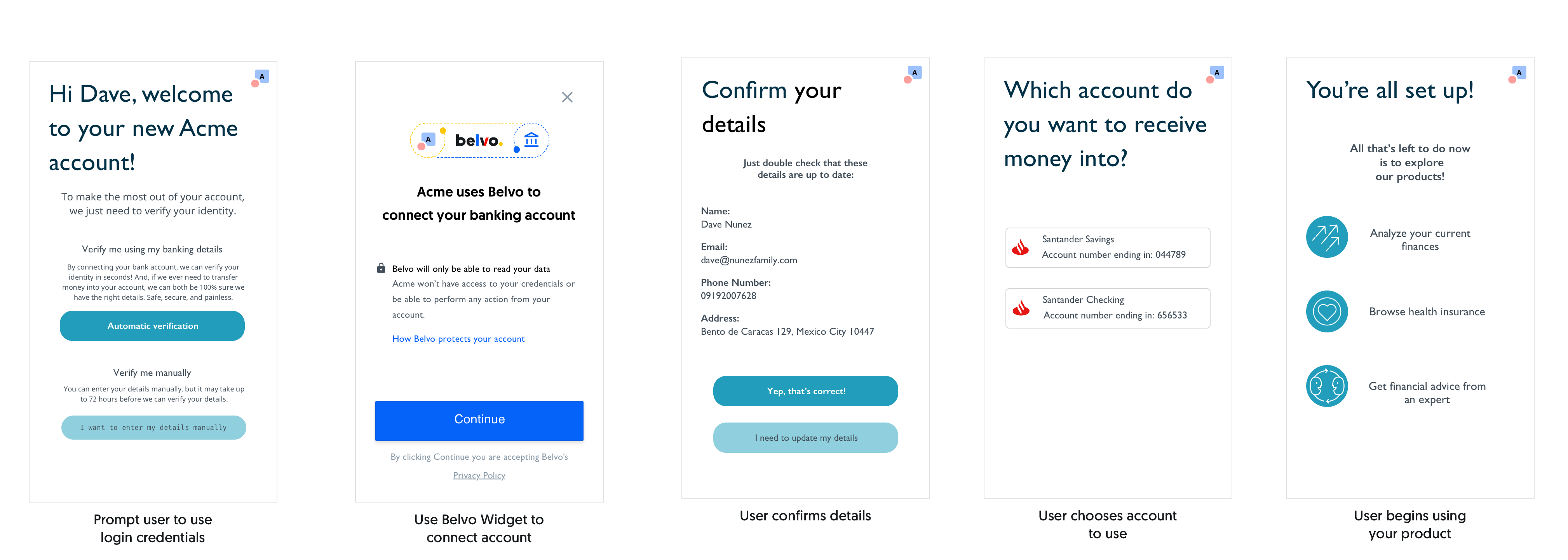

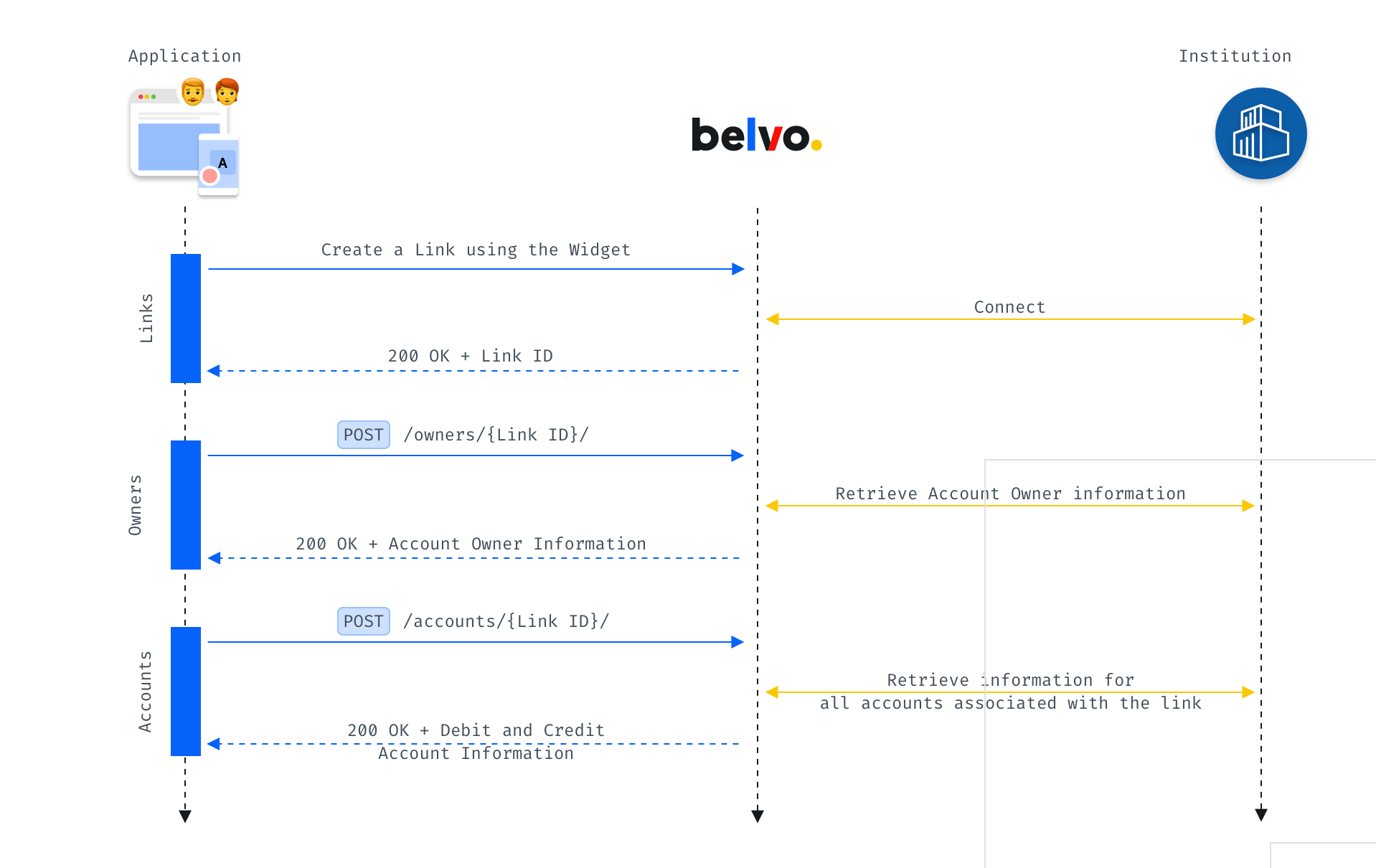

General Flow

In the diagram below, you can see the general flow of the calls you'll need to make, and the information you will receive, to verify your client's identity and account information.

Single Links

We recommend that you use single links when performing ID verification. This is because these details don't usually change, and as such, you will not need to keep this information updated.

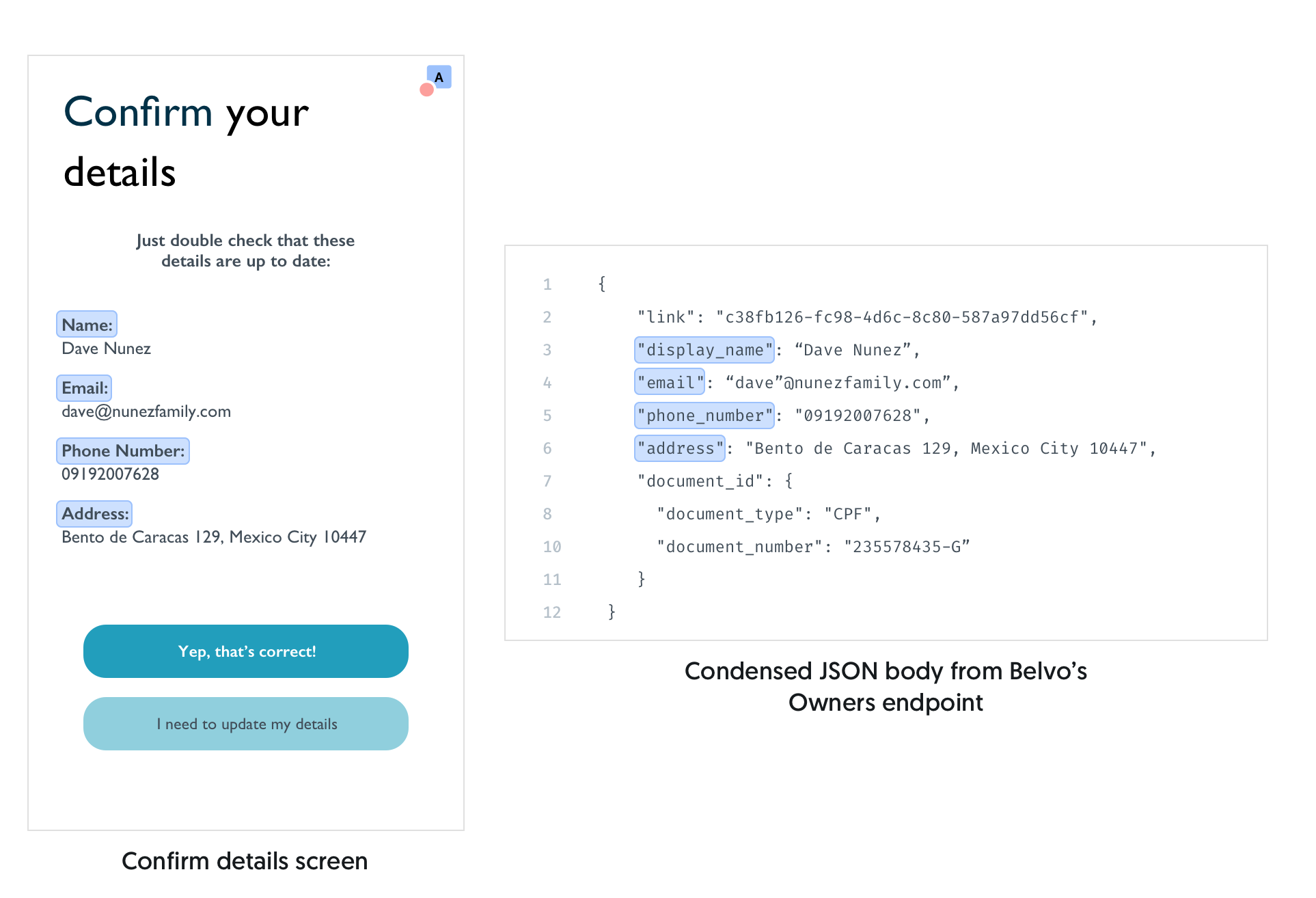

Owners: confirm your client provides the right details

Why look at the Owner details?

By getting the owner's details, you can quickly extract:

- their full name

- phone number

- address

- Information regarding the document they used to open the account

The information that you can extract depends on the institution and the information required to open an account.

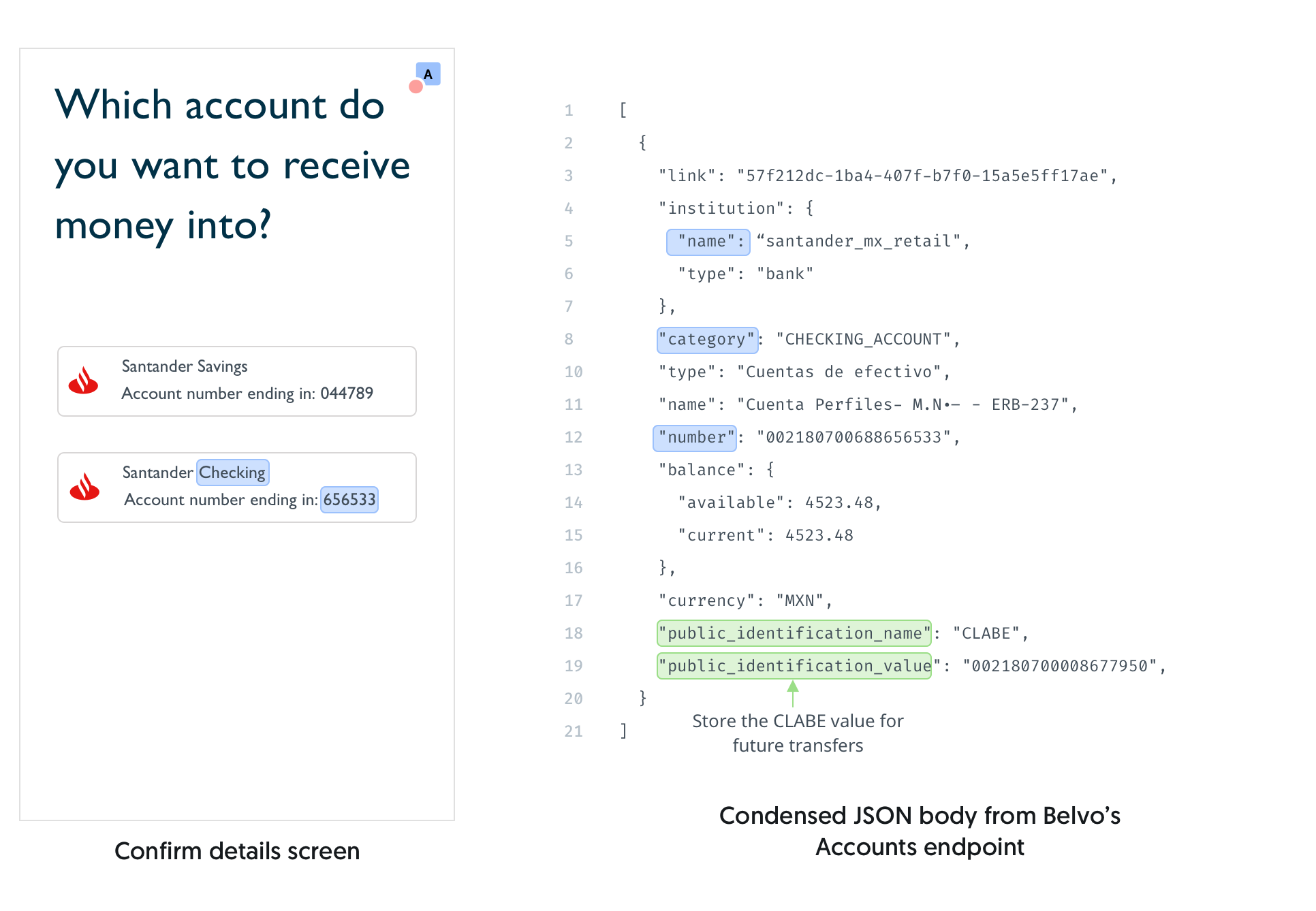

Accounts: select the right account

Why look at your user's accounts?

By looking at your user's accounts, you can extract the correct:

- Bank account type

- Bank account number

- Banking institution

With these three data points, you'll ensure that you'll always have the right information to pay your clients.

Done!

And just like that, you can not only quickly and programmatically verify your user's information as well as accounts, but also pre-populate multiple fields. If you'd like to know what other information you can extract from these two endpoints, make sure to check out our:

Related Guides

Banking API

Follow these high-level flows using Belvo's Banking product to:

Assess the lending risk of your retail client

See how to combine multiple endpoints and extract the right information to perform a risk analysis of a client.

Help users manage their finances

See just how easy it is to get the right data to help your users manage their finances.

Fiscal API

Use our Fiscal product to quickly:

Verify your user using fiscal information

Use Mexico's SAT to verify your users fiscal information.

Updated 7 months ago